The Repurchase Rate: A Look at This Often-Overlooked e-Commerce KPI — and Why It Matters

Thanks to robust reporting tools and new ways to analyze collected data, you now have more information at your disposal than ever before. Some things are easy to focus on – your primary KPIs that indicate just how well your brand is performing and what approaches are working for you. Other KPIs offer beneficial details, but they are often overlooked just because of the sheer amount of data available.

One of those marketing metrics that e-Commerce startups need – but often overlook – is the repurchase rate. Many e-commerce brands tend to focus on other aspects like the acquisition of new customers, and the data surrounding the process take center stage. Your repurchase rate looks at an entirely different set – and one that is incredibly beneficial to your bottom line, your repeat customers.

What Is Your Repurchase Rate?

Your repurchase rate is the percentage rate of customers who placed another order within a particular time frame. This metric is typically calculated within specific time frames from the first order date.

Multiple items in a single order don’t count — this metric looks at many sales. Your repurchase rate can help you in two key ways.

- It can indicate how many customers are returning to you with orders, which gives you insights into the customers you should be cultivating.

- It also reveals which of your products align with your market — your customers let you know this by making purchases.

The items they repurchase most often are clear winners and should be examined for a variety of purposes.

You can define your repurchase rate based on the date — how many customers repurchased within 30/60/90 days — or by item.

Knowing how these important metrics look can help you better present products to your customers, increasing your chances of making a sale. Assigning a cohort date to each customer (based on the month that buyer first purchased) can help you track how much time elapses between purchases as well. For example, if you know that your customers typically repurchase 60 days after their initial purchase, you know exactly when to launch a targeted campaign for that cohort.

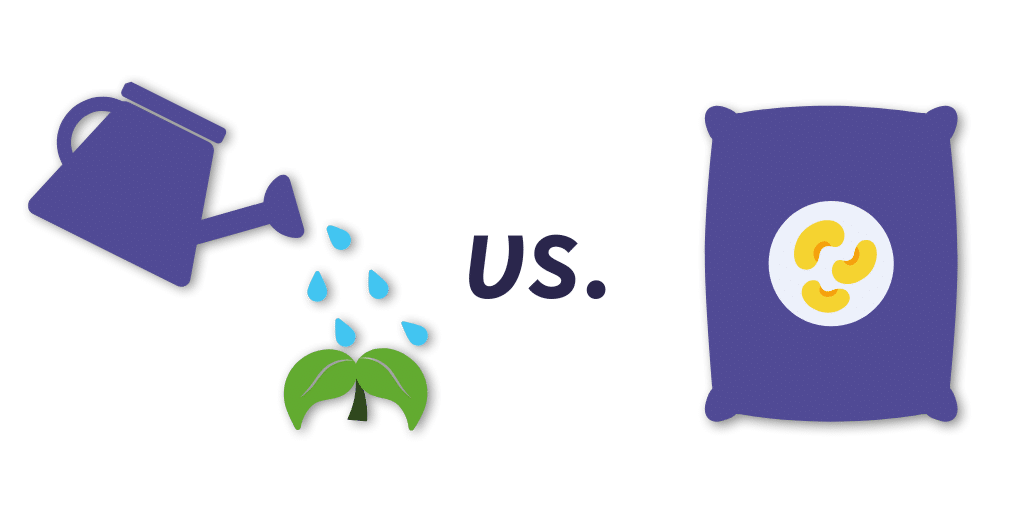

Retention vs. Acquisition

Focusing on customer retention and selling additional items to your existing customers have some significant benefits over the acquisition, including:

- Low cost: Selling to your current, repurchasing customers can be as simple as sending an email to this highly motivated segment, an approach that is far less expensive than buying advertising or PPC campaigns.

- Low barriers: When you seek to acquire a new customer, you have to find them, make them aware of your brand, make them trust you, then present a solution or product compellingly. When you resell to an existing customer, most of these barriers have already been addressed, leaving you free to offer your product or solution.

- Smooth closing: A happy incentivized return customer who wants “more” of something is ready to place an order, and closing can be as simple as presenting them with an offer. You can also more readily introduce new products to this friendly group.

Retention Rate and Your Products

Your repurchasing customers matter for your brand, but so do the products they buy. When you look at the repurchasing data from your e-commerce store, you should be able to get a very clear idea of which products are the most appealing.

Products with the highest repurchase rates are items that your buyers have deemed most desirable through their purchasing behaviors. These high-performing products also represent your best market match; use them to determine if a new line or product you are considering will be appealing to your target customer base.

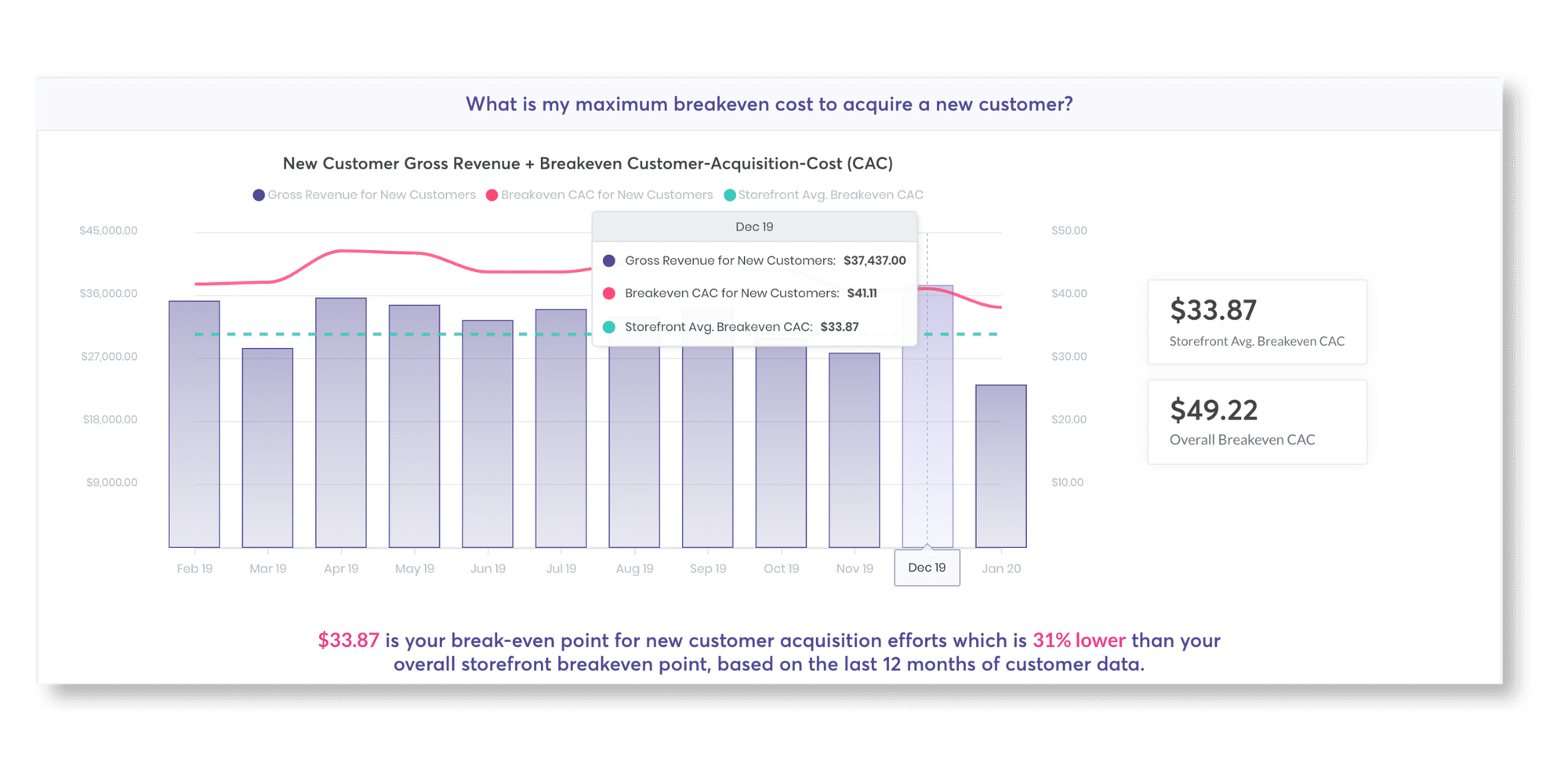

Repurchase Rate and Paid Channels

If you are using paid campaigns, you’ll have a Customer Acquisition Cost (CAC).

This metric can be used to optimize your return on advertising investments. The lower your cost, the better. In other words, if you reduce the costs to extract money from customers, your company’s profit margin will improve and gain more significant profits.

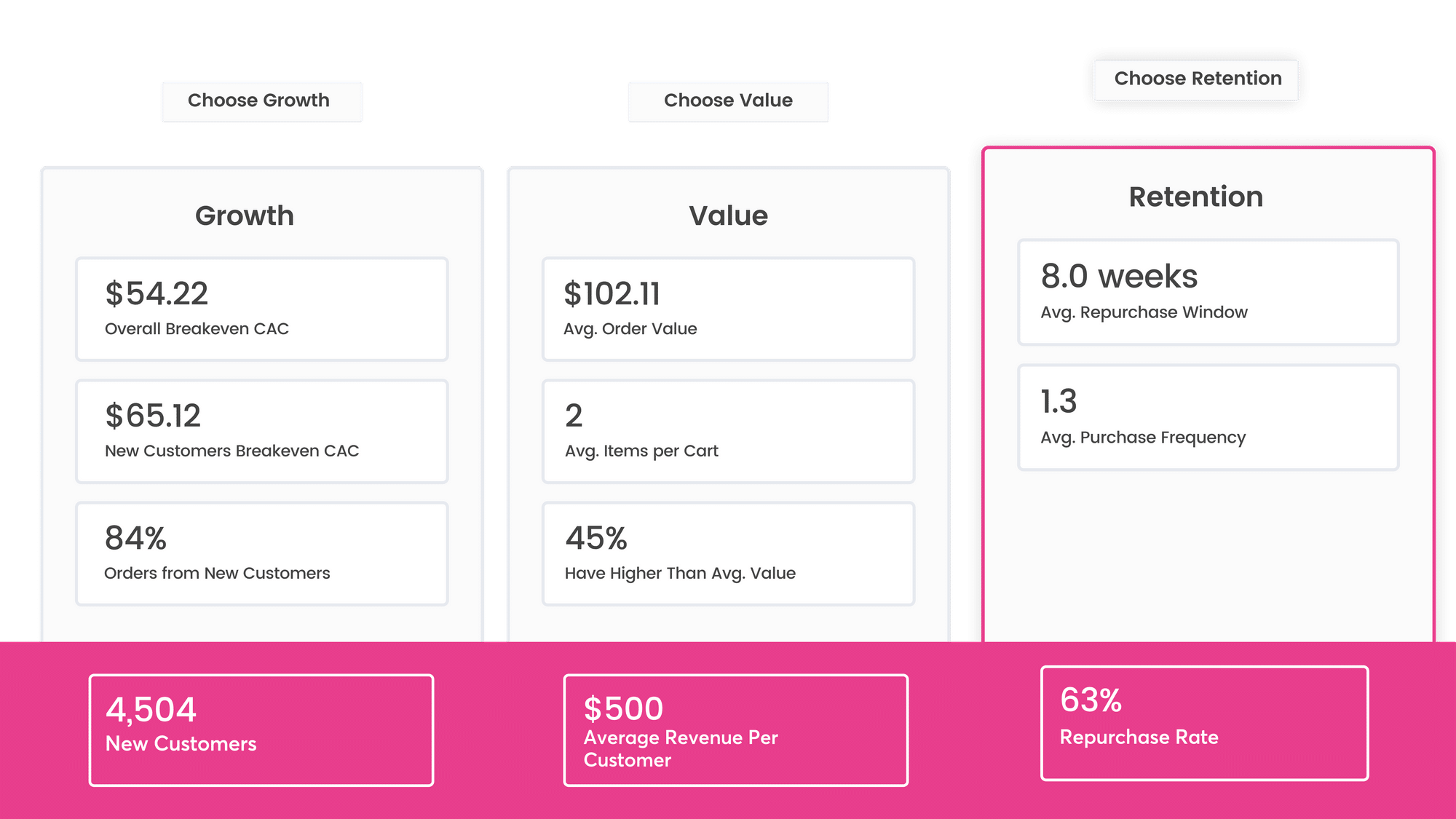

When you know your repurchase rates, you’ll have an excellent way to estimate the time it will take to pay for your CAC. And with DataQ, you can quickly gain insight on your repurchase rates and CAC.

Repurchase Rates and Annual Customer Revenues

The more frequently your customers buy, and the more they add to their repeat orders, the higher your overall per-customer rates will be. Since it costs less to upsell an existing customer than it does to generate entirely new business, understanding the type of customer who repurchases and the products they buy can help you improve your overall revenues per customer each year.

Gain Insights You Can Use

Your repurchase rate can reveal a lot about your brand and the customers that buy from your business. When you know how likely it is that a customer will repurchase during a set amount of time, you can create a marketing strategy that uses this information to boost your revenues. With DataQ, not only will you know your repurchase rate, but you’ll also have accompanying data descriptions, best-practice strategies, and accompanying targeting audiences to implement in your marketing channels.

Revisit this metric, and you’ll learn a lot about your brand and the people who buy from you.

Our Editorial Standards

Reviewed for Accuracy

Every piece is fact-checked for precision.

Up-to-Date Research

We reflect the latest trends and insights.

Credible References

Backed by trusted industry sources.

Actionable & Insight-Driven

Strategic takeaways for real results.